The Ultimate Guide to Supercar Finance

Discover How to Make Supercar Ownership a Reality Through Expert Financing

For many driving enthusiasts, owning a supercar is the absolute pinnacle of automotive achievement. As one of the UK’s leading supercar dealer, Romans International offer finance for all our vehicles but we also work very closely with our sister company Elev8 Finance, and together we appreciate that financing a supercar requires careful consideration and expert guidance. This comprehensive guide will walk you through everything you need to know about supercar finance, from understanding different finance options to making informed decisions about your investment.

Let's be honest – there's nothing quite like the feeling of sitting behind the wheel of a supercar for the first time. Whether you've been dreaming of a Ferrari's iconic red finish, the distinctive roar of a Lamborghini's V12, or the cutting-edge engineering of a McLaren, we are here to help you achieve that passion. We've spent decades turning customers' dreams into reality, and we've learned that the journey to supercar ownership is just as exciting as the destination!

Key Takeaways

- Supercar finance is more accessible than ever, with flexible options available for various financial circumstances

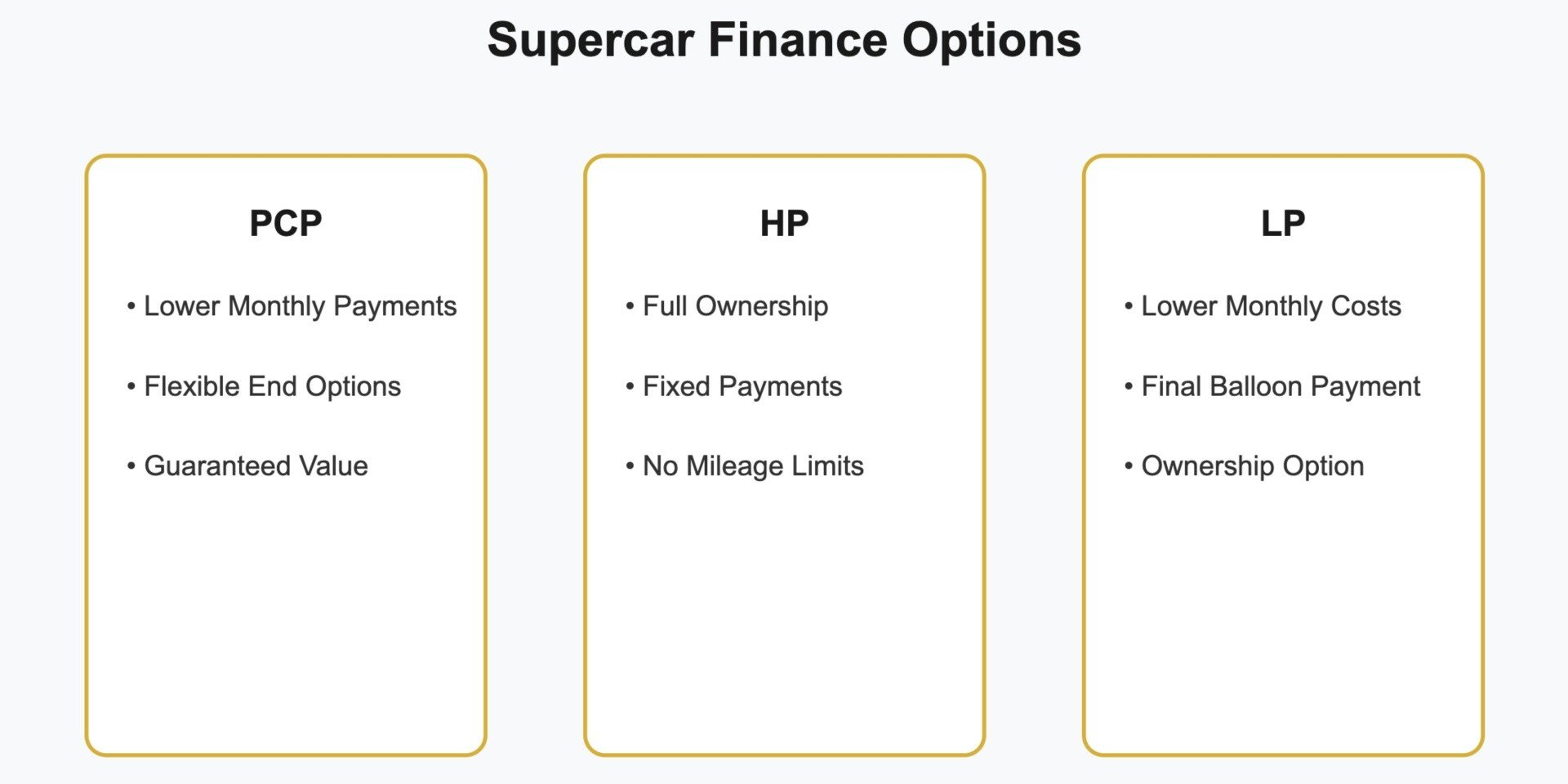

- Multiple finance solutions exist – PCP, HP, and LP each offer distinct advantages depending on your goals

- Typical deposits range from 10% to 20%, though terms can be tailored to individual circumstances

- Early settlement options provide flexibility if your situation changes

- End-of-agreement choices include keeping the car, upgrading to a new model, or walking away

- A strong credit history is important, but each application is assessed individually

- Having an existing supercar on finance doesn't prevent you from financing another

- Regular payments can positively impact your credit rating

- Professional guidance from experienced dealers like us here at Romans International can streamline the process

- Tax benefits may be available, particularly for business users

- The best finance solution is as individual as your choice of supercar

Can You Finance a Supercar?

"Can I really finance a supercar?" is often the first question we hear from aspiring owners. The answer is an absolute, yes! Gone are the days when supercars were exclusively reserved for cash buyers; today's finance solutions have evolved to be as sophisticated as the cars themselves, making that dream garage more achievable than you might think.

Whether you're looking to acquire a Porsche, Aston Martin, Lamborghini, or any other prestigious marque, various financing options are available to help make your pipe dream a certain reality. Modern supercar finance solutions are designed to be flexible and tailored to individual circumstances. In this article, we’ll talk you through the benefits of supercar finance, how it works, cost considerations, end-of-agreement options, and more…

Benefits of Financing a Supercar

Supercar ownership isn’t as complex as you might think. Many customers we speak with think that a cash purchase is the only option – or even the best option. However, in today's financial landscape, strategic use of supercar finance can offer significant advantages that even high-net-worth individuals take advantage of.

Through our years of experience at Romans International, we've helped drivers discover that intelligent financing can transform their supercar ownership aspirations. Even if you could buy it outright, let's explore why financing your supercar might be smarter than you think:

Preserved Capital

Keep your capital working as hard as your engine: Why tie up all your funds in one asset when you could keep them invested elsewhere? Smart financing lets you enjoy your supercar by spreading the cost over a designated period, while your money continues to grow in other investments.

Keep Your Collection Current

Stay ahead of the curve with regular upgrades and swap the old for the new. As we know, the supercar world moves fast so financing gives you the flexibility to upgrade to the latest models without waiting to sell your current car. It’s much easier to transition to newer models through a structured finance agreement.

Tax Advantages

There are potential perks that would even impress your accountant! For business users, various finance structures can offer significant tax advantages. As such, you could benefit from capital allowances on eligible vehicles, VAT recovery on certain finance agreements, and tax-deductible interest payments on business loans.

Asset Protection

Preserve your existing investments and assets while adding the dream car to your collection. That’s the beauty of enjoying supercar ownership by financing.

Terms to Suit You

Much like a bespoke suit, your supercar finance plan should fit you and your lifestyle perfectly. Lenders can create customisable payment plans to suit your financial situation, whether that’s a higher deposit option, mid-term refinancing opportunity, or early settlement flexibility.

How Does Supercar Finance Work?

The journey from dream to driveway doesn’t need to be complicated. We understand that every supercar investor has unique financial circumstances and lifestyle requirements. At both Romans International and Elev8 Finance, we work with a panel of specialist lenders to create bespoke payment structures that align perfectly with your financial strategy.

We've refined the art of supercar finance to ensure a seamless process for our clients, and here we explain the main routes to supercar ownership, each offering its own unique advantages:

Personal Contract Purchase (PCP)

Picture PCP as the Swiss Army knife of supercar finance – versatile and adaptable. You'll start with a deposit, enjoy lower monthly payments, and then face what we like to call the "sweet dilemma" at the end - you can either: keep your supercar, hand back the keys and try something new, or use any equity you've built up to step into your next automotive adventure.

Hire Purchase (HP)

Considered to be the more traditional route to supercar ownership, HP is like a well-maintained classic – straightforward and reliable. You'll put down a deposit, make fixed monthly payments, and before you know it, you'll have full ownership of your pride and joy. This option is simple, effective, and satisfying.

Lease Purchase (LP)

Think of LP as the more flexible cousin of Hire Purchase. You'll enjoy lower monthly payments throughout the agreement, with a balloon payment waiting at the finish line. It's perfect for those who want to keep their monthly commitments lower while building up to that final ownership moment.

Alternative Funding Solutions for Supercar Ownership

While traditional finance options like PCP, HP, and LP are popular routes to supercar ownership, they are not the only solutions. If straightforward supercar finance isn’t for you, then we encourage you to explore alternative funding that leverages your existing assets. For example:

Equity Release

Equity release allows you to access the value tied up in your existing assets without selling them. This can be particularly attractive for supercar acquisition as it maintains your current investment portfolio while enabling new opportunities.

Asset Refinancing

Asset refinancing involves restructuring existing finance arrangements or leveraging owned assets to fund your supercar purchase. This approach can offer strategic advantages for high-net-worth individuals and business owners.

Why Consider Alternative Funding?

Alternative funding solutions can offer several advantages over traditional supercar finance, including:

- More competitive interest rates

- Greater flexibility in terms and conditions

- Potential tax perks

- Portfolio optimisation opportunities

- Preserved investment capital

- Enhanced privacy in high-value transactions

When considering alternative funding solutions, it's important to make the right choice. We recommend you evaluate your personal situation and consider important factors such as overall portfolio impact, tax implications, long-term financial strategy, risk profile, and exit strategy options.

Cost Considerations for Supercar Finance

While the prospect of calculating costs might seem daunting, we've found that well-informed customers make more confident decisions. The total cost of financing your supercar depends on several elements that work together to create your bespoke finance package.

The purchase price of your chosen vehicle naturally forms the foundation, but it's the combination of your deposit, finance term length, and prevailing interest rates that will determine your monthly commitments. Your credit profile plays a significant role too, potentially unlocking more favourable terms, while your chosen finance product can dramatically impact the overall cost structure.

To help in your research, we’ve outlined the key financial factors that will help shape your supercar finance package:

Deposit Requirements: Your First Step

The initial deposit is your first major decision in the supercar finance journey. Typically ranging from 10% to 20% of the vehicle's value, your deposit choice can significantly influence your monthly payments and overall finance terms. However, we understand that every client's financial situation is unique, which is why we work with specialist lenders who can offer flexible deposit arrangements.

Your upfront payment will be influenced by several factors, including:

- Your financial circumstances and preferences

- The specific supercar model you're interested in

- Current market conditions and lender criteria

- Your chosen finance product structure

- Long-term ownership plans

Understanding Interest Rates and Terms

Interest rates for supercar finance aren't simply fixed numbers - they're as carefully crafted as the vehicles themselves. Your rate will be tailored based on a combination of market conditions, your financial profile, and the specific characteristics of your chosen supercar. We work to secure competitive rates that reflect both the premium nature of your purchase and your individual circumstances.

Monthly Payment Structures

Your monthly payments are the practical reality of supercar ownership, and we believe in ensuring these align perfectly with your financial rhythm. The amount you'll pay each month is influenced by various factors, such as the term length of your agreement - typically ranging from 24 to 60 months, with certain arrangements extending longer for optimal payment structuring.

Then there’s the size of your initial deposit which also plays a crucial role here, as a larger upfront payment generally leads to lower monthly commitments. Your chosen finance product, whether PCP, HP, or LP, will also significantly impact the monthly payment structure.

We'll help you explore different scenarios to find the perfect balance between initial deposit, monthly payments, and optional final payments, ensuring your supercar finance package fits seamlessly into your financial lifestyle.

Early Settlement Options

Most supercar finance agreements can be settled early, offering flexibility if your circumstances change and the opportunity to upgrade sooner. But bear in mind if you choose this option, it might involve a settlement fee. However, the advantages of early settlement mean you could potentially make savings on interest or release equity for other investments.

End of Agreement Options: Deciding Your Next Move

The end of your supercar finance agreement is by no means the end of the journey - it's an opportunity to reassess and potentially elevate your position. As your agreement approaches its final stages, you'll be presented with a number of options. Whether you've fallen completely in love with your current supercar or you're feeling ready to experience something new, there’s a solution to tick your boxes.

If You Want to Keep the Car:

- Pay any outstanding balloon payment to complete ownership - this is a straightforward path to making the car definitively yours

- Refinance the balloon payment to maintain manageable monthly costs while retaining your cherished vehicle

- Sell the car privately and settle the finance agreement - do this by exploring private sale options with our expert guidance, potentially benefiting from market appreciation

If You Want to Change Cars:

Return the vehicle under your agreement terms, having enjoyed the full supercar experience without a long-term commitment

Use any equity you've built up as a stepping stone to an even more exceptional model

Take advantage of market conditions and our extensive network to transition smoothly into your next supercar

Refinancing Your Supercar: Expanding Your Options

Refinancing your supercar is a possibility and might be particularly advantageous when:

- Interest rates have shifted favourably since your original agreement

- Your financial circumstances have improved, potentially qualifying you for better terms

- You're approaching a balloon payment but want to keep your vehicle

- Market conditions have increased your vehicle's value, creating equity opportunities

- Your business structure or tax position has changed

- You're looking to consolidate multiple vehicle finances

The Pros and Cons of Supercar Finance

In the interest of being transparent we appreciate that financing a supercar may not suit everyone. So you can get a clearer picture of the advantages versus the disadvantages, we’ve created the table below:

| Advantages | Disadvantages |

| Manageable monthly payments | Interest costs |

| Preserved capital | Mileage restrictions on some agreements |

| Flexible end-of-term options | Potential early settlement fees |

| Potential tax benefits | Maintenance requirements |

| Regular upgrade opportunities | Regular payments to maintain |

Are You Ready to Start Your Supercar Journey?

So why Choose Romans International for supercar finance? Well, we're not just another dealership – we're supercar enthusiasts who happen to offer competitive finance solutions through our sister company, Elev8 Finance.

Over the years, we've built something special here at our showroom in Surrey: a place where passion meets expertise, where dreams meet reality, and where every client becomes part of our story. Our team has handled everything from first-time Ferrari purchases to multi-car collections, and we bring that wealth of experience to every conversation.

Get in touch for a personalised quote where you can also take advantage of the integrated supercar finance calculator to outline your preferred term and deposit, alongside the desired monthly payments.

Frequently Asked Questions About Supercar Finance

Q: Is It Easy to Get Supercar Finance?

A: You might be surprised to learn that financing a supercar isn't as daunting as it sounds. While there's a thorough assessment process involved, we've helped countless clients navigate it smoothly. The key factors that'll influence your application are your credit history, proof of income, the size of your deposit, and of course, which stunning machine you've set your heart on. The good news is our team knows exactly how to present your application in the best light.

Q: What Credit Score Do I Need?

A: Here's the thing about credit scores – there's no magic number you need to hit. While a strong credit score certainly helps, we look at the bigger picture. Ask yourself these questions: Are you financially stable? Do you have a reliable income stream? What about other assets? We've secured successful finance packages for clients with varying credit profiles because we take time to understand their complete financial story.

Q: How Long Can You Finance a Supercar For?

A: First we recommend you identify whether you fancy a short-term arrangement or prefer to spread the cost over a longer period. Supercar finance agreements can range from 24 months right up to 7 years in some cases. Most of our clients opt for something in between – typically 4 to 5 years – as it strikes a nice balance between manageable monthly payments and overall cost.

Q: Can I Finance a Classic Supercar?

A: Absolutely you can! Classic supercar finance is a bit of an art form – and one we've mastered over the years. We'll look at things like the car's age (obviously), its potential to appreciate (because let's face it, some classics are basically four-wheeled investments), its condition, and making sure it's properly insured. Whether you're eyeing up a classic Ferrari or a vintage Aston Martin, we can help make it happen.

Q: Do You Need a Guarantor for Supercar Finance?

A: Not always, but it can be a helpful ace up your sleeve, especially if you're new to the supercar world or perhaps younger than the typical buyer. Think of a guarantor as your financial wingman – they might help you get approved faster or secure better terms. But don't worry if you don't have one; we've got plenty of other routes to explore.

Q: What Insurance Do I Need for a Financed Supercar?

A: This is where you really want to dot your i's and cross your t's. Comprehensive coverage is a must (naturally), but there's more to consider. We always recommend agreed value insurance – because let's be honest, standard insurance valuations rarely do justice to these cars. GAP insurance is worth thinking about too, and if you're planning any track days (and who wouldn't be?), you'll want specific cover for that. Don't worry though – we know all the right people in the specialist insurance world, so can point you in the right direction.

Q: What Happens if I Miss a Payment?

A: Life can throw curveballs – we get it. The most important thing is not to panic and to get in touch with your finance provider straight away. Missing a payment isn't the end of the world if you handle it properly. If you’re unsure where you stand, we can help you understand your options, whether that's arranging a payment plan or looking at restructuring your agreement. The key is communication – the sooner you reach out, the more options you'll have.